Guns, Loopholes, And A Good Laugh

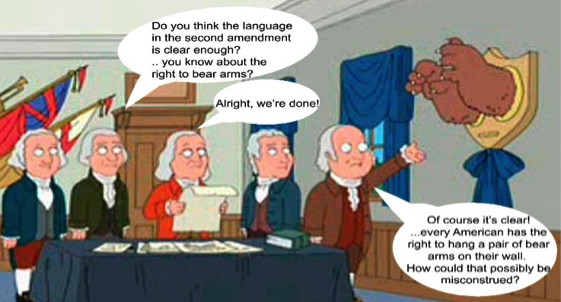

First of all, thank you to the clever creators of the television show Family Guy, and Twentieth Century Fox Film Corp. for their comical take on our 2nd Amendment’s “Right to Bear Arms.”

We’ve heard it all when it comes to guns. Some people love guns. Some people hate guns. Some believe gun control means eliminating guns all together. Some believe gun control means using both hands when firing them. The good news—for this post it doesn’t matter what your personal feeling about guns are—this is just a simple review of some gun ownership and transfer requirements. After all, you may hate guns, but a gun lover may leave them to you at their death.

So, let’s keep this simple—and here’s a generalized blanket statement: most firearms (single shot or semi-automatic shotguns, rifles, and handguns--those not governed by the National Firearms Act) don’t require any elevated requirements to purchase or transfer the firearms (you just have to pass the background check and fill out the application correctly). This is similar to the “Responsible Person” requirement discussed below. So, gun lover walks into store, picks out gun, fills out application correctly, passes background check, purchases gun, and takes it home. Transferring these at death doesn’t provide any issues, unless they are transferred to someone who wouldn’t have been approved to buy one in the first place. However, issues arise when those “other” firearms are involved.

The National Firearms Act governs these “other” types of firearms, which is policed by the ATF; and these “other” types (referred to as NFA Title II Firearms) are:

(1) a shotgun having a barrel or barrels of less than 18 inches in length; or a weapon made from a shotgun if such weapon as modified has an overall length of less than 26 inches or a barrel or barrels of less than 18 inches in length (think sawed-off shotgun);

(2) a rifle having a barrel or barrels of less than 16 inches in length; or a weapon made from a rifle if such weapon as modified has an overall length of less than 26 inches or a barrel or barrels of less than 16 inches in length (think sawed-off rifle);

(3) any other weapon (think strange weapons; like pen guns, umbrella guns, etc.)

(4) a machinegun (think fully automatic guns);

(5) any silencer (Bond, James Bond…); and

(6) a destructive device (grenades, missiles, bombs, etc.).

To purchase one of these, you must go through a background check and be a “Responsible Person” as described by the ATF and outlined in their form which I’ve linked: https://www.atf.gov/firearms/docs/form/national-firearms-act-nfa-responsible-person-questionnaire-532023/download . If you’re a Responsible Person, at the time of purchase you pay an additional $200 transfer tax (unless the weapon falls into the “All Other Weapons” classification). And yes, the ATF keeps records of these firearms you acquire.

Remember, I mentioned “loopholes” in the title. Some folks have created gun trusts to own NFA Title II firearms. A trust is not a person. Therefore, a person could purchase one of these firearms and avoid the background check! The other reason gun trusts are created is to allow trust ownership of the firearm; thus avoiding any additional transfer taxes down the road as long as the gun stay in the trust and is used by those identified in the trust. That all changed last summer by the passage of law that now states a trust falls within the definition of person. Now the trust’s grantor, and those listed as trustees, must all be Responsible Persons and pass the background check. The end beneficiary must be as well. Otherwise, being in possession of one of these could lead to felony conviction!

So, you hate guns, but one of these fancy “other” NFA Title II firearms is supposed to go to you at someone’s death, or you are now the one appointed to carry out the distribution of the estate. What do you do? Leave the firearm locked away (don’t take it with you) and talk to me, or someone at the local gun shop. We can help you navigate the transfer quagmire and all the forms that come with it. Thankfully, the new rule removes additional transfer taxes if the firearm passes to an estate and you are the personal representative (much like a gun trust). The challenge is, keeping the ATF informed of all of your actions and staying on top of those forms!

As for a good laugh—the cartoon gave me a good laugh when I first saw the episode years ago. I also think that old loophole presented a form of comedy as well!

I hope you could ‘bear’ reading this!

If you want to learn more about estate planning or gun trusts and how we can help you protect your family, call us at 317-863-2030 or click here to fill out our easy form and we'll call you!

Kyle Allen, Attorney at Law, www.HunterLawOffice.net