Are you Choosing the Right Legal Structure for Your Company in the UAE?

Embarking on a business venture in the vibrant United Arab Emirates (UAE) requires careful consideration, starting with selecting the appropriate legal structure for your company. This decision transcends mere administrative formalities; it profoundly impacts operational dynamics, tax responsibilities, legal liabilities, and avenues for expansion. In the UAE, entrepreneurs can opt for either Mainland or Free Zone entities, each accompanied by unique benefits and governed by specific regulations.

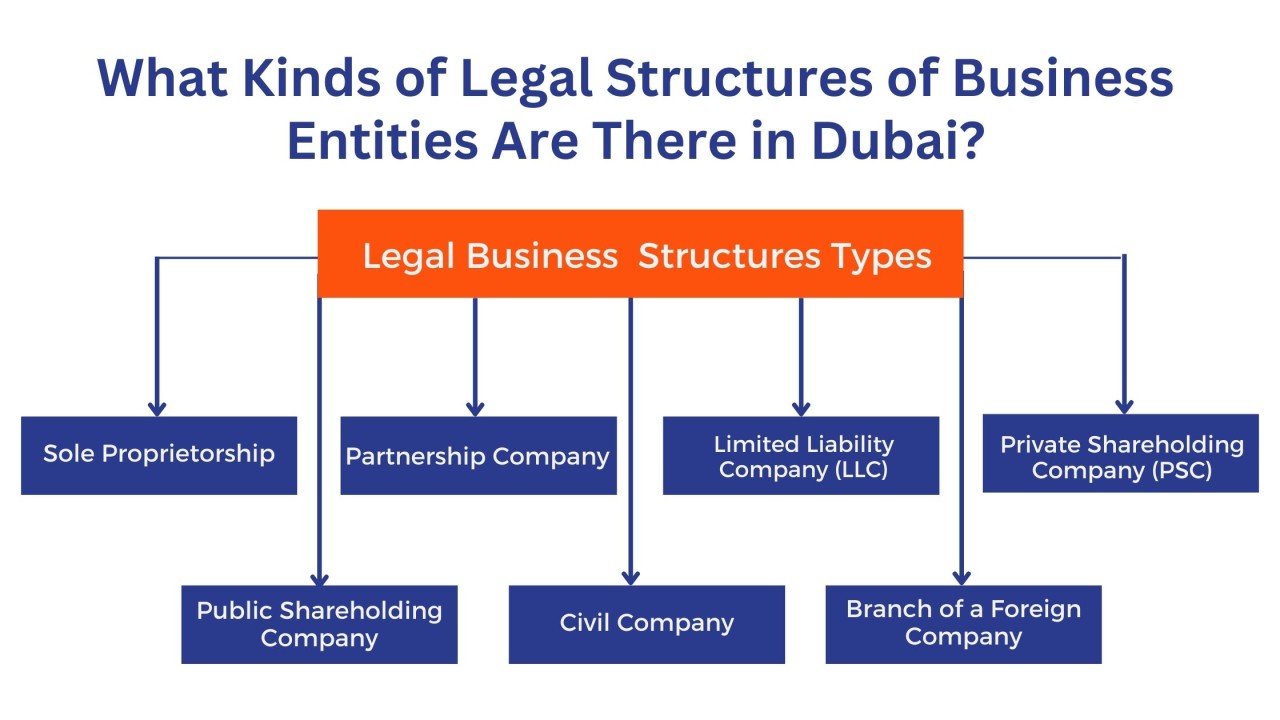

Exploring Mainland Legal Structures for Business Ventures in the UAE

The Mainland legal structures in the UAE offer a wide spectrum of options, catering to diverse business activities and facilitating deeper engagement with the local market. Let's delve into the various options available for Mainland company setup in Dubai, UAE:

1. Sole Establishment: Ideal for individuals seeking full control over their business, a sole establishment, or sole proprietorship, is owned and managed by a single person. However, the owner bears unlimited liability, risking personal assets to settle business debts.

2. Branch of a GCC Company: Companies already established in the GCC can expand their operations by opening branch offices in the UAE Mainland. These branches function as extensions of the parent company without constituting a separate legal entity.

3. Civil Company: Professionals like consultants, lawyers, or engineers often opt for a civil company structure, where partners share liability based on their ownership percentage. This partnership model is suited for service-oriented businesses.

4. Branch of a Local Company: Local UAE businesses looking to expand geographically within the country can establish branch offices under the legal umbrella of the parent company. This allows for regional expansion without the need for separate entities.

5. Limited Liability Company (LLC): Widely favoured for its limited liability feature, an LLC enables shareholders to limit their liability to their share in the capital. Versatile and adaptable, LLCs can engage in a wide range of commercial, industrial, and professional activities.

6. Holding Company: Established to control shares or assets of other companies, a holding company is strategically valuable for consolidating subsidiaries and enhancing financial management.

7. Public Joint Stock Company (PJSC): PJSCs offer the opportunity to raise capital by selling shares to the public, making them suitable for large-scale enterprises. A minimum of ten founding members is required to establish a PJSC.

8. Representative Office of a Foreign Company: Foreign companies can set up representative offices in the UAE for market research and promotional activities. However, these offices are not permitted to conduct commercial transactions.

9. Private Joint Stock Company: Suited for companies desiring the structure of a PJSC without going public, a private joint stock company allows for multiple shareholders and operates under slightly different regulations.

Understanding these Mainland legal structures empowers businesses to make informed decisions and choose the most suitable option for their needs and aspirations.

Exploring Free Zone Legal Structures for Global Business

UAE Free Zone Company Setup are tailored to attract foreign investment by offering advantages such as full ownership and tax exemptions. Let's take a closer look at the legal structures available in Free Zones:

1. Free Zone Limited Liability Company (FZ LLC): An FZ LLC operates independently, providing limited liability to its shareholders. It stands out for its tax exemptions, customs duty benefits, and the absence of restrictions on foreign labour.

2. Free Zone Company (FZ Co.): Like an FZ LLC, an FZ Co. offers limited liability but often features a more flexible shareholding structure. It's an appealing option for international companies establishing subsidiaries in the UAE.

3. Free Zone Establishment (FZE): An FZE is designed for single shareholders and shares the benefits of FZ LLCs and FZ Cos. It offers a streamlined setup process, making it popular among startups and individual entrepreneurs.

Choosing the right legal structure for your company in the UAE demands a thorough evaluation of your business objectives, industry, scale of operations, and growth prospects. Whether you're drawn to the expansive opportunities on the Mainland or the strategic advantages of a Free Zone, each legal form presents its own set of regulations, perks, and responsibilities.

Consider consulting with experts specializing in the region for personalized guidance and support in navigating the complexities of establishing your business in the UAE. By selecting the optimal legal structure, you can lay a solid groundwork for your company's prosperity in the dynamic UAE market.