March 8, 2019 NASCUS Report

Posted March 8, 2019States expand shares of assets,

memberships in 2018, year-end stats show

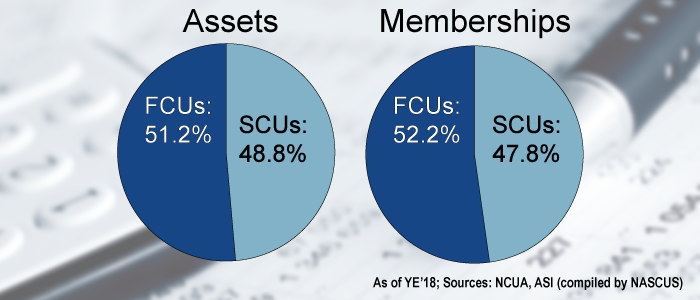

State-chartered credit unions increased their share of total credit union assets in 2018, and saw their portion of memberships rise too, according to numbers compiled by NASCUS, based on data released by NCUA this week. The count of total credit unions fell again in 2018, continuing a long-term trend.

According to the NASCUS compilation (which includes both federally insured, state-chartered credit unions (FISCUs) and privately insured credit unions (PICUs)), state-chartered credit unions at year-end 2018 held 48.8% of all credit union assets – up slightly from the year before, when they held 48.5%.

State CUs now hold $716.9 billion in assets; federal credit unions hold $753.6 billion. The SCUs saw overall annual growth in assets of just about 6% (or 5.9%), expanding their total at a slightly faster clip than federal credit unions, which grew at just under 5% (for 4.9%).

In memberships, state-chartered CUs held 56.2 million, according to the year-end numbers – 47.8% of all memberships; federal CUs held 61.3 million, or 52.2% of all memberships. That represents a slight rise from 2017, when the states had 47.5% of all memberships (and FCUs had 52.5%). The state CUs saw membership growth of 4.9%; FCUs membership rolls expanded by 3.7%.

The numbers of both state and federal credit unions fell in 2018, as they have in recent years. At 2,113, SCUs declined by 3.6% in 2018 (losing 79 from the previous year); the FCU total declined by 3.5% (falling by 123) to 3,376.

“Prudent supervision emphasizing an environment of safety and soundness blended with responsive regulation continues to strengthen the state credit union system,” said Lucy Ito, president and CEO of NASCUS. “In partnership with sound management by state credit union professional staff and boards, the state system is well positioned to continue providing vigorous service to American consumers.”

LINK:

NCUA Releases Q4 2018 Credit Union System Performance Data

NCUA TO DISTRIBUTE $160M TO FEDERALLY INSURED CUS

Federally insured credit unions will receive an equity distribution of more than $160 million this year from the fund that insures savings in the institutions, NCUA said Thursday, the second such distribution announced in the last year (and the second largest ever).

In a release, NCUA said that, based on the total of insured shares reported in fourth quarter 2018 Call Reports, the equity ratio of the National Credit Union Share Insurance Fund (NCUSIF) was 1.39% at the end of 2018. The agency noted that level is above the NCUA Board-approved normal operating level (NOL) of 1.38%. To reduce the equity ratio to the approved normal operating level, a $160.1 million distribution is required, the agency said.

Under the insurance fund equity distribution rules of the agency, a financial institution that filed a quarterly Call Report as a federally insured credit union for at least one reporting period in calendar year 2018 will be eligible for a pro ratadistribution. The agency noted that the eligibility criteria for credit unions to receive an equity distribution is detailed in the final rule approved by the NCUA Board in February 2018.

In 2018, the agency distributed nearly $736 million from the insurance fund, NCUA pointed out, after voting to close the Temporary Corporate Credit Union Stabilization Fund (TCCUSF). Earlier in 2017, the board proposed closing the fund, merging its remaining assets into the credit union savings insurance fund (the (NCUSIF), and distributing any funds left over in the insurance fund above the 1.39% NOL.

LINK:

Board Approves Share Insurance Equity Distribution in 2019

NASCUS: AGENCY KEEPS WORD; OTR REDUCTION HELPED

NASCUS’s Lucy Ito, in press statement, said the state system applauded the board’s action. “The reduction of the normal operating budget shows that NCUA is monitoring systemic risk and adjusting the normal operating level as they committed to do when they raised the equity ratio of the insurance fund in September 2017,” she said.

“We also acknowledge that NCUA’s reduction of the overhead transfer rate also contributes to the insurance fund’s equity level, thereby providing a greater distribution that benefits both state and federal credit unions,” she added.

BOARD TO TAKE UP FINAL RULE ON LOANS, LINES OF CREDIT

The NCUA Board will consider a final rule on loan and lines of credit to members at its regular, open monthly meeting next week, and will hear a first-quarter 2019 report on the National Credit Union Share Insurance Fund (NCUSIF).

In its comment letter on the proposal – issued in August and which proposed to make the NCUA’s loan maturity requirements more “user friendly” by identifying in one section all of the various maturity limits applicable to federal credit union (FCU) loans — NASCUS discussed the aggregate borrower limits applicable to federally insured state-chartered credit unions (FISCUs), noting that the state system supports efforts to bring clarity to NCUA’s rules and regulations.

“As currently organized, NCUA’s disparate borrower limitations are often difficult for federally insured credit unions to easily locate,” NASCUS wrote. “For FISCUs, that difficulty is compounded by the nature of Part 741 (of agency rules), which incorporates NCUA provisions by reference. To further clarify which rules apply to FISCUs, NCUA should incorporate FISCU applicable loan limitations in Part 741.203 in their entirety.” NASCUS added in the letter that NCUA’s rules allow for states to seek an exemption for FISCUs if the state of their prudential regulator promulgates similar rules. “NCUA should preserve this preemption,” NASCUS wrote.

The meeting gets underway Thursday at 10 a.m. in the NCUA Board meeting room at agency headquarters in Alexandria, Va.

LINK:

NCUA Board agenda, March 14

STATE SYSTEM HAS A VOICE IN NEXT WEEK’S GAC …

Thousands of credit union advocates from across the country will be in Washington next week, and NASCUS will be among them discussing issues and policies related to the state credit union system.

The Credit Union National Association’s (CUNA) Government Affairs Conference (GAC) – the largest gathering of credit union advocates and supporters of the year — is expected to draw up to 5,000 credit union-related representatives over the five-day run of the session (Sunday through Thursday), who will confer on credit union issues generally, hear from law- and policymakers, and meet with representatives on Capitol Hill.

NASCUS will be in the thick of it all, with leadership of the organization (including Board Chairman John Kolhoff, Credit Union Advisory Council Chairman Rick Stipa, and President and CEO Lucy Ito), meeting with other credit union groups, sharing ideas with federal regulators and discussing issues with lawmakers on Capitol Hill.

Among the groups NASCUS is scheduled to meet with over the course of the event: American Association of Credit Union Leagues (AACUL), National Association of Federally insured Credit Unions (NAFCU), CUNA Mutual Group, National Association of Credit Union Service Organizations (NACUSO), NCUA, Treasury – and more.

NASCUS will have follow-up reports about its activities related to the GAC next week.

… WHERE KEY ISSUES WILL BE ON TAP FOR STATE SYSTEM

As NASCUS is talking with lawmakers, policymakers and others within the credit union system at large at the GAC next week, the focus of the discussions (from NASCUS’s point of view) will be on some key issues, among them:

- NCUA Board reform: NASCUS advocates for at least one board member with state credit union supervisory experience, and an Increase in the board size from three to five members.

- Data breach notification: Now, all states have data breach notification requirements in place; NASCUS recommends that — where the state law is more stringent — deference should be given to state law.

- Clarity for serving legal marijuana businesses: NASCUS backs legislation that addresses the conflict between federal and state law on the provision of products and services for legitimate marijuana enterprises.

- Executive compensation excise tax (tax reform): The state system seeks a comparable exemption from the 21% excise tax on pre-existing executive compensation contracts for non-profits (such as credit unions) in parity with for-profit entities for which pre-existing executive compensation contracts have been grandfathered.

In addition to advocating positions on issues, NASCUS will also use the opportunity to reacquaint all with its role: as a liaison of the state credit union system to federal agencies such as NCUA, CFPB, Treasury, and more, as well as representing the interests of state agencies before Congress; serving as the primary resource and national voice of the state credit union system, and; advocating for a safe, sound and viable state credit union system.

CFPB’S KRANINGER SITS FOR FOUR-HOUR HEARING IN HOUSE

Setting priorities for the federal consumer protection agency, including the tone for how it operates as an agency, are the tasks ahead for its new director, she told a congressional oversight hearing Thursday at the start of a four-hour hearing marked by partisan back and forth throughout.

Kathleen (“Kathy”) Kraninger, the director of the Consumer Financial Protection Bureau (CFPB), told the House Financial Services Committee that she expects to “emphasize stability, consistency, and transparency as hallmarks” as her administration of the bureau works to “mature the agency and institutionalize the many partnerships that are key to our success.”

Kraninger was facing her first oversight hearing before Congress as director of the bureau; she was sworn in for a five-year term in December.

During the hearing, Democrats zeroed in on the agency’s proposal to change its rule on payday lending, scheduled to take effect in August, and remove the provision requiring lenders to prove that a borrower can afford to repay the loan. Kraninger fended off the concerns telling her questioners that that bureau would, essentially, let the regulatory process take its course. The proposal is out for comment until May 15 (although a separate proposal, to delay the effective date for the mandatory underwriting provisions of the regulation to August 2020, closes for comments March 18).

(Click on the image to see the brief exchange between Rep. Brad Sherman, D-Calif., and CFPB Director Kathleen Kraninger at Thursday’s hearing.)

BUREAU DIRECTOR, CA REGULATOR IN TOUCH

During another portion of the hearing, Rep. Brad Sherman (D-Calif.) mentioned the bureau’s proposal – issued this week – to prescribe regulations on residential “Property Assessed Clean Energy (PACE)” financing (as required under regulatory relief legislation enacted in last spring). PACE financing, under the new law (the Economic Growth, Regulatory Relief and Consumer Protection Act (EGGRCPA, S. 2155) is defined as “financing to cover the costs of home improvements that results in a tax assessment on the real property of the consumer.”

Sherman urged Kraninger to make the proposal a high priority, and recommended she discuss the issue with California Commissioner of the Department of Business Oversight Jan Lynn Owen. “These loans started in California; we’ve had a wealth of experience, we’ve passed legislation, and I think it can provide you with additional input.”

Kraninger quickly responded to Sherman that “I actually have met with Jan and spoken to her about this topic. I can appreciate what California has done on it and we are working very closely together on it.”

In other comments, Kraninger told the committee:

- CFPB is still culling through comments submitted through former Acting Director John (“Mick”) Mulvaney’s “requests for information” from last year. Overall, nearly 90,000 comments were submitted on 12 RFIs issued for comment. Three RFIs dominated the comments, generating 97% of the letters received.

- A new permanent director of the bureau’s office of servicemember affairs has been hired; Jim Ryan takes his seat in the office Monday, Kraninger said. He fills an office that has been vacant for 18 months.

- The bureau is taking a close look at the section in the Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank) dealing with unfair, deceptive or abusive acts and practices (UDAAP).

- The CFPB director confirmed to the committee that her last name is pronounced with a hard “g” sound (and not the soft “j” sound), although she said she answers to either pronunciation.

SENATE NEXT TO HEAR FROM BUREAU DIRECTOR

The Senate will have its own turn at the federal consumer financial protection agency when it holds an oversight hearing next week, again featuring Director Kraninger. The hearing is billed as the CFPB’s “Semi-Annual Report to Congress” to the Senate, as was this week’s House hearing. However, Kraninger is the only witness for the hearing (unlike the panel that also testified in the House event), and no legislation is on the table for CFPB in the Senate hearing

LINK:

The Consumer Financial Protection Bureau’s Semi-Annual Report to Congress

REGULATORS ADOPT ‘REPORT OF EXAM’ PRINCIPLES

Principles for more clearly presenting “report of examination” (ROE) information were issued Wednesday by the federal financial institution regulators, which includes (the regulators said) an effort to promote “consistency, clarity and ease of reference.”

In a release, the Federal Financial Institutions Examination Council (FFIEC) said its “Policy Statement on the Report of Examination” was developed as part of its examination modernization project. The project, it said, is aimed at reducing unnecessary regulatory burden on community financial institutions. In addition, the group said – in issuing the principles — FFIEC is rescinding its 1993 Interagency Policy Statement. That statement, part of FFIEC’s Uniform Core Report of Examination, is replaced by the new policy statement.

The FFIEC said the principles set forth minimum expectations of what should be part of all ROEs; see the link below for complete details.

LINK:

FFIEC Members Adopt Policy Statement on the Report of Examination

NASCUS 101: COMING YOUR WAY APRIL 25 FOR INSIGHTS TO STATE SYSTEM

The official NASCUS 101 Member Orientation is coming on April 25, a can’t-miss, a no-charge, one-hour webinar that brings together members, prospective members or anyone else interested in NASCUS (the voice of the state credit union system) to better understand the unique tools and benefits NASCUS offers. Attendees also hear from their peers—a member network of state regulators, credit unions, credit union leagues, and other system supporters—and how they leverage their NASCUS membership. The webinar ends with a Q&A session. Advance registration required; sign up today!

LINK:

Agenda, registration for April 25 NASCUS 101 webinar (no charge)

BRIEFLY: NCUA says TRID safe harbor met if form completed

Four “frequently asked questions” issued by CFPB last month about the TILA-RESPA Integrated Disclosure (TRID) rule are a focus of an NCUA Consumer Financial Protection update released Thursday. In particular, the update notes that the fourth of the FAQs (issued by the Consumer Financial Protection Bureau, CFPB) addresses whether use of a model form provides a safe harbor if the form does not reflect a TRID rule change finalized in 2017. “Appendix H to Regulation Z (TILA, the Truth in Lending Act) includes blank and non-blank model forms. If a credit union accurately completes the applicable model form, it meets the safe harbor,” NCUA states.

LINK:

CFPB Releases FAQs for Complying with TRID Rule Change

For more information about NASCUS's news and/or public relations, please contact our Marketing and Communications Department.